Optimizing User Experience in Magento Introduction In today’s competitive e-commerce landscape, delivering a seamless user experience (UX) is essential. For…

In today’s fast-paced business environment, managing finances is crucial for growth, especially for startups and small businesses across the United States. Outsourced bookkeeping and accounting services offer an efficient solution to handle financial records, tax preparation, and payroll management without the need for an in-house team. Businesses from New York to Texas are increasingly leveraging these services to focus on what matters most—growing their businesses.

Outsourcing bookkeeping and accounting services can save time, reduce costs, and minimize errors, making it an appealing option for entrepreneurs and small business owners. In this blog post, we will explore the benefits, services, and best practices for outsourcing your financial needs, along with how this trend is helping companies in different states across the U.S.

Get Free Business Audit

We assist businesses and individuals worldwide, sticking to Islamic principles.

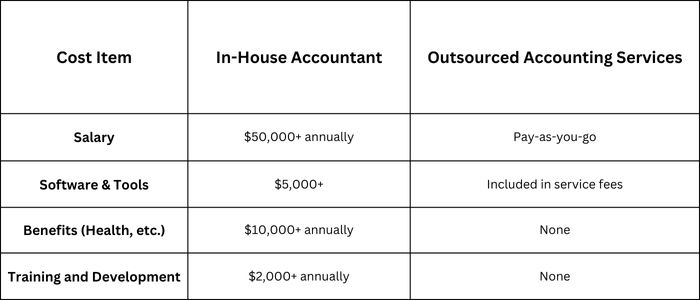

Outsourcing your bookkeeping and accounting services can result in significant cost savings, especially for small businesses. Instead of hiring full-time, in-house staff, you can pay for services as you need them. This eliminates the need for salaries, benefits, and overhead costs.

For example, small businesses in cities like Los Angeles and Chicago have found that outsourced services allow them to scale their financial management without breaking the bank. External accountants also tend to be experts in the latest software, which means fewer mistakes and better efficiency.

Outsourcing allows business owners to focus on what they do best—running their businesses. Managing finances, tax preparation, and payroll processing can take hours of valuable time each week. By outsourcing, you can allocate more time toward core activities such as business development, customer service, and marketing.

In Austin, Texas, for example, many startups have benefited from outsourcing bookkeeping services, allowing them to grow rapidly without being bogged down by financial management. It’s no wonder why outsourcing is becoming a go-to solution for companies across the U.S.

By outsourcing to professional accountants, your financial records are handled by experts who understand the latest tax laws, accounting standards, and software systems. This results in fewer errors, timely reports, and better compliance with IRS regulations.

For example, businesses in Miami, Florida and San Francisco, California, where tax laws may vary, are taking advantage of outsourced bookkeeping firms to avoid costly mistakes during tax season.

Outsourced services are flexible, allowing businesses to scale their financial needs up or down depending on the season. During peak business times, you can request additional services, while during slower periods, you can cut back, making it a cost-efficient solution.

Bookkeeping is the foundation of good financial management. Outsourced bookkeepers help maintain daily records, including expenses, revenue, and receipts, ensuring that your financial statements are always up to date.

Internal Link Suggestion: Read more about Bookkeeping Basics on Hazara Digitals.

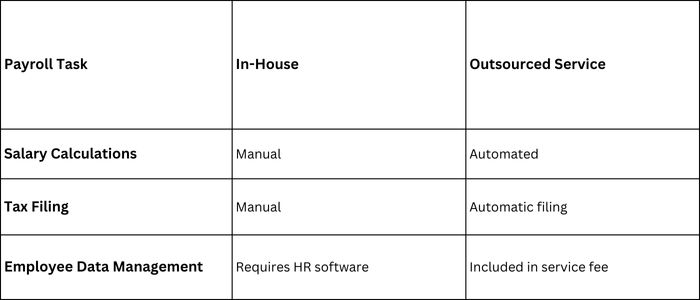

Handling payroll can be time-consuming and requires accuracy to avoid legal penalties. Outsourced payroll services ensure that employees are paid on time, tax withholdings are managed correctly, and payroll taxes are filed.

Keeping up with tax regulations is one of the most complex parts of financial management. Outsourced accountants are well-versed in federal and state tax requirements, ensuring that your business stays compliant and reduces its tax burden.

For example, businesses in New York City, where local taxes may apply, rely on outsourced services to handle complex tax situations.

Outsourced accounting firms offer detailed financial reports, including balance sheets, cash flow statements, and profit and loss reports. These reports are crucial for making informed business decisions and attracting investors.

In the event of an audit, outsourced accounting firms can offer audit support to ensure that your books are in order. Many businesses, especially those in Atlanta, Georgia, have found peace of mind knowing their financial records are ready in case of an audit.

Selecting the right service provider is crucial to the success of your business. Here are some key factors to consider when choosing an outsourced bookkeeping and accounting firm in the USA:

Ensure that the firm has experience working with businesses in your industry. For example, a firm that understands the needs of tech startups in Silicon Valley may offer different services compared to one that specializes in retail businesses.

Choose a firm that offers flexibility in terms of services, pricing, and scalability. This is especially important for businesses that experience seasonal fluctuations, such as tourism-related companies in Orlando, Florida.

Outsourced firms should be up-to-date with the latest accounting software, such as QuickBooks, Xero, or FreshBooks. They should also be able to integrate their services with your existing business tools.

Check reviews and testimonials from other clients. Many businesses in Denver, Colorado, for example, find comfort in knowing that their service providers have a proven track record of success.

Financial data is sensitive, so it’s essential to choose a firm that prioritizes data security. Ensure that the firm follows the best practices for data protection, particularly if you’re working with remote teams.

Many small businesses believe that outsourcing accounting is only for large corporations. However, businesses of all sizes, from startups in Seattle to local stores in Houston, benefit from outsourcing.

Some business owners fear that outsourcing will result in less control over their finances. However, with modern technology, you have real-time access to your financial data at all times.

Outsourcing may seem like an additional expense, but it often costs less than hiring a full-time employee. Plus, the potential savings from avoiding errors and tax penalties can make outsourcing a cost-effective solution for businesses in cities like Boston, Massachusetts.

For startups in the USA, investing in custom Shopify or WordPress development can be the key to long-term success. By tailoring your website to meet your specific business needs, you’ll create a strong online presence that helps attract and retain customers.

Custom development allows startups to scale, adapt, and stand out in today’s crowded digital marketplace. Whether you’re launching an e-commerce store or building a portfolio site, choosing the right platform—and customizing it—will set your startup up for success.

Optimizing User Experience in Magento Introduction In today’s competitive e-commerce landscape, delivering a seamless user experience (UX) is essential. For…

How to Build a Profitable Shopify Store: Step-by-Step Guide for Success Starting an online store can be a game-changer, especially…

SEO Services USA Elevate Your Business to the Top of Search Results Introduction: Why SEO is Essential for Businesses in…